SyBridge Completes Acquisition of the Assets of Toolplas Systems México

Published on May 5, 2021

SyBridge Technologies (“SyBridge”), a global technological leader in the tooling and mold industry, announced today that its subsidiary, Concours Technologies (“Concours”), has completed the acquisition of the assets of Toolplas Systems Mexico S. de R.L. de C.V. (“Toolplas Mexico”). This transaction marks the further expansion by SyBridge in the service business, especially in serving customer needs in Mexico. New York-based private equity firm Crestview Partners established SyBridge in 2019 and committed $200 million of equity to create a market leader spanning across end-markets, geographies, and advanced technological capabilities to provide value-added solutions to its customers.

Querétaro Facility

Parque Tecnologico Y Innovacion Bodega 7 y 8, El Marques Querétaro, Mexico CP 76246

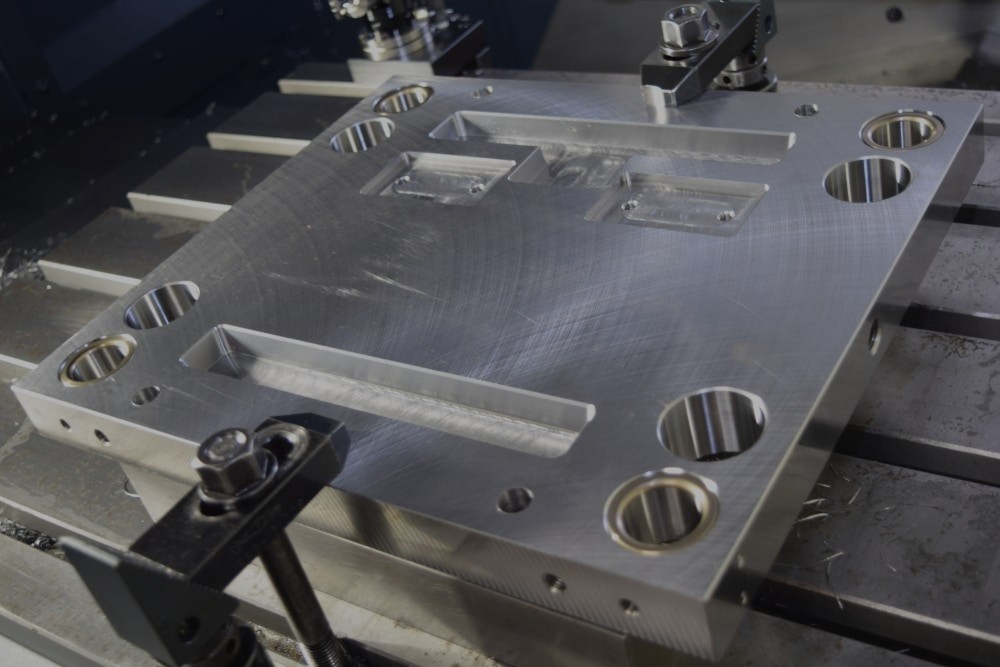

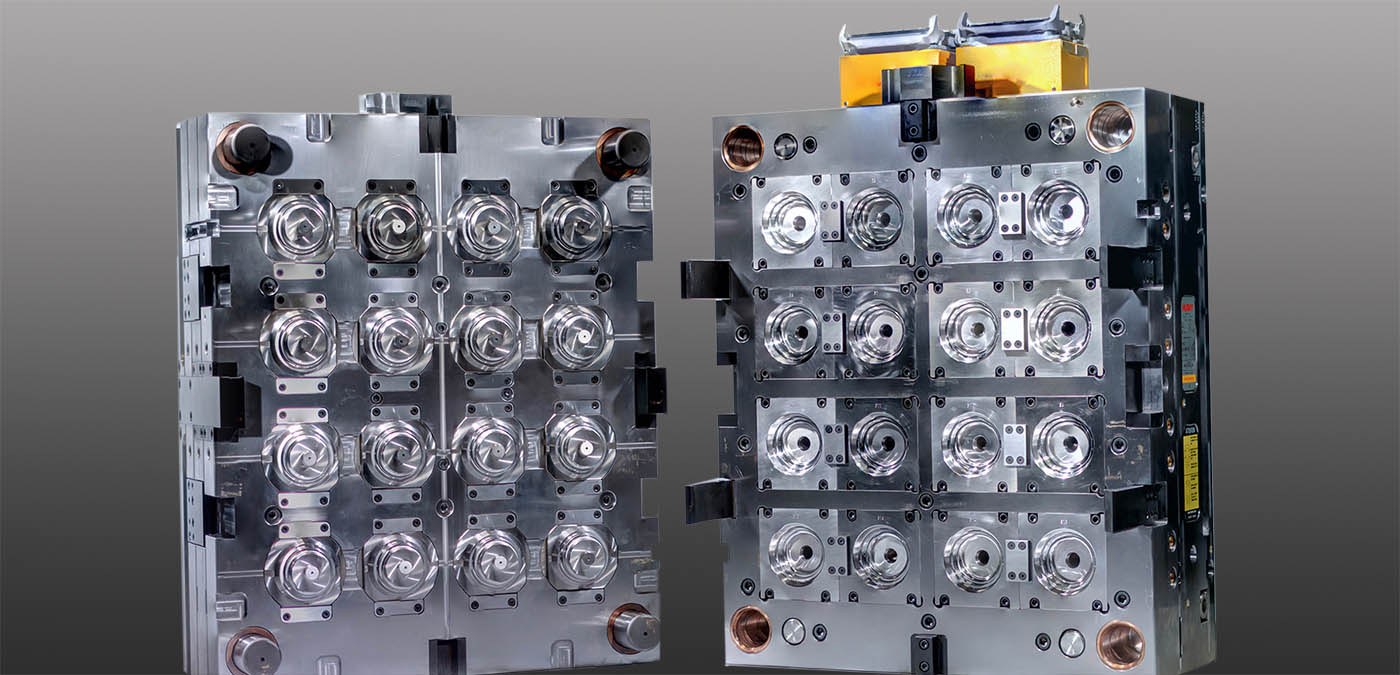

The acquisition of Toolplas Mexico assets enables SyBridge to add a dedicated service center in the Queretaro area, where significant injection molding production is located. It also allows Concours’ existing production facility in Puebla Mexico to focus on mold design, manufacturing, and validation. The addition of this Queretaro service center increases SyBridge’s customer service network to four dedicated service facilities in North America; it will complement other locations in Alabama, Tennessee, and Ontario Canada.

“Queretaro is strategically located; having a service center there helps us to better meet customers’ engineering changes, mold repair and maintenance needs in Mexico,” said Tony Nardone, CEO of SyBridge. “We now have dedicated service centers in all 3 countries under USMCA and will add several more to match the manufacturing footprint of our customers. Building an industry-leading technology and service business is a key element of SyBridge’s overall growth strategy.”

About SyBridge Technologies

SyBridge Technologies was established in 2019 by Crestview Partners to create a global technological leader that provides value-added design and production solutions across multiple industries. SyBridge is based in Southfield, Michigan.

About Crestview Partners

Founded in 2004, Crestview is a value-oriented private equity firm focused on the middle market. The firm is based in New York and manages funds with over $9 billion of aggregate capital commitments. The firm is led by a group of partners who have complementary experience and distinguished backgrounds in private equity, finance, operations and management. Crestview has senior investment professionals focused on sourcing and managing investments in each of the specialty areas of the firm: industrials, media, and financial services. For more information, please visit www.crestview.com.