Originally published on fastradius.com on October 21, 2020

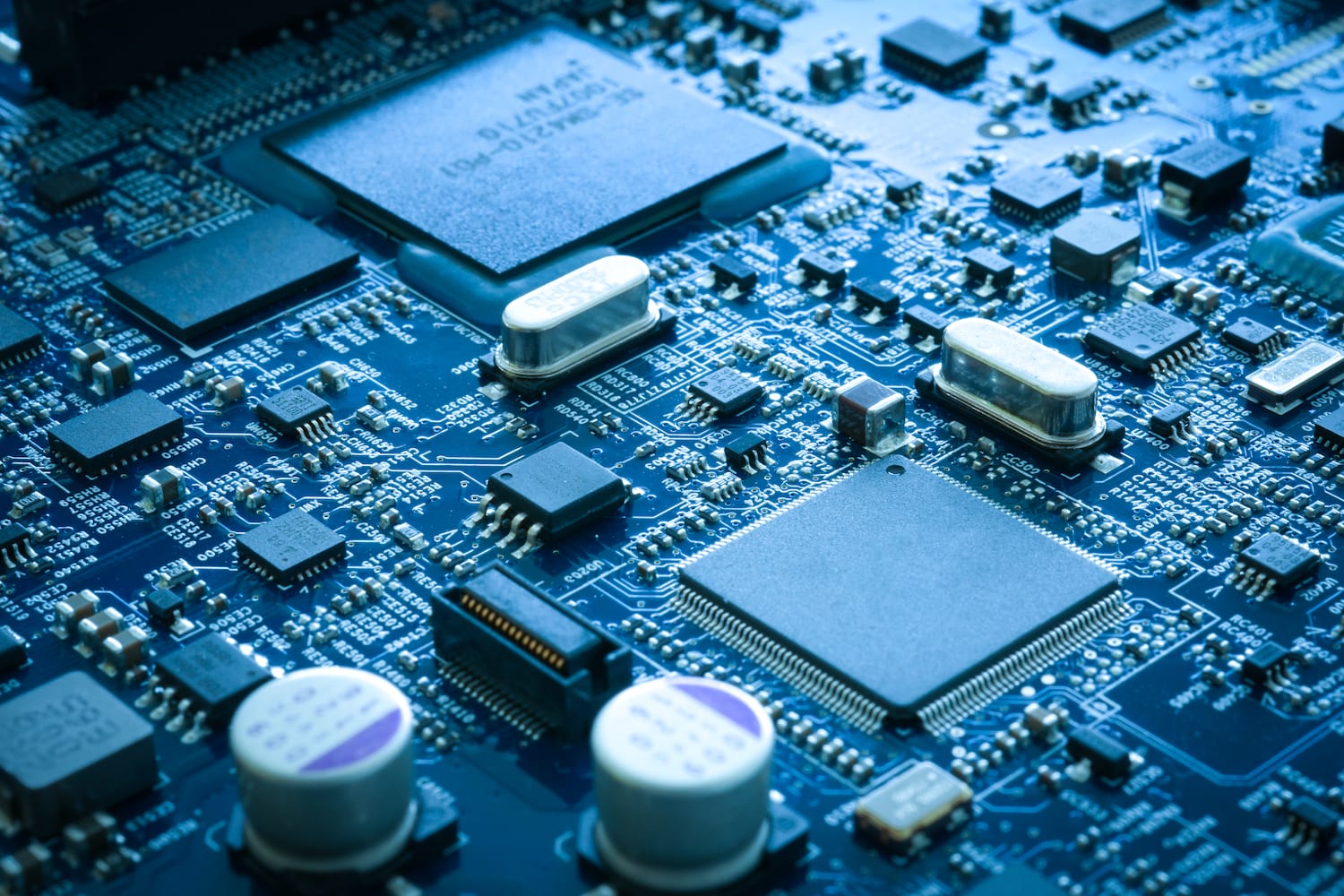

Semiconductor devices feature electronic circuit components made from materials like silicon, that aren’t good insulators or conductors. These devices are compact, reliable, cost-effective to produce and play a key role in powering many of the cutting-edge digital devices in use today.

For example, the growth of the global semiconductor industry over the past few years can be attributed to global demand for digital devices, communication electronics, and applications powered by the Internet of Things (IoT). Today’s top products — from smartwatches to smart homes to smart appliances — are defined by their digital capabilities, and semiconductor technology makes it all possible.

Based on current projections from Deloitte, global semiconductor sales are on track to generate $542.64 billion in revenue by 2022, and 39.5% of that revenue will be due to communication and connected consumer electronics alone.

Product teams and manufacturers can tap into the dynamic and incredibly lucrative semiconductor industry by creating consumer electronics housings for semiconductor devices. These housings embed intelligent chips into the product and ensure that it functions properly. Manufacturers should keep these four key semiconductor industry trends in mind as they seize the opportunity to secure a foothold in this growing field.

Semiconductor technology has advanced so much over the years that chips have become incredibly dense. Moore’s law — the widely held perception that the number of transistors on a microchip doubles every two years — is in full effect but, paradoxically, Moore’s law also seems to be flattening in the semiconductor industry. As the complexity of semiconductor technology increases, manufacturers and engineers have a harder time fitting more complexity onto chips. The same can be said for the connectors and electronic housings that accompany said chips.

Additive manufacturing is the manufacturing method best-suited for fitting numerous connection points on a small, incredibly intricate part, and semiconductor device manufacturers are taking notice. Injection molding used to be the manufacturing method of choice for these parts, but semiconductor companies have realized that they’ve reached the natural productivity limits of this technique and features cannot be made any smaller.

With 3D printing, engineers can produce and customize complex geometries, create designs that are safe for wire channels and will disperse heat for PCB components, and do so more quickly and cost-effectively than with traditional manufacturing. Also, these connectors can have a similar look and feel to injection molded parts. Manufacturers who specialize in additive have a huge opportunity here to partner with up-and-coming semiconductor manufacturers.

Thanks to industry 4.0 and IoT, wireless devices have become the norm for both commercial and industrial applications. Semiconductor sensors, like those found in temperature-controlled warehouses or trucks, need enclosures made of materials that allow wireless and radio frequency (RF) signals through them.

As such, semiconductor manufacturers are seeing a surge in demand for polycarbonate and fiberglass enclosures. These materials enable the free transmission of wireless signals, provide excellent connectivity, can withstand high temperatures, and offer good impact resistance. Materials like polycarbonate and fiberglass will become more popular as semiconductor manufacturers in the power and energy sector include more IoT sensors in their grids.

Several decades ago, semiconductor companies outsourced packaging and final testing because these were seen as low-level functions that wouldn’t make or break a product. Now, many of these same companies have the exact opposite view. Most semiconductor companies today outsource front-end die manufacturing to share the high costs of new process development, which have skyrocketed.

Additive manufacturing companies with global manufacturing networks have the most to gain from this newfound interest in outsourcing. The Asia Pacific region made up 70% of semiconductor sales in 2018 and Technavio estimates that 35% of future growth in the industrial electronic enclosures market will originate from APAC between 2020 and 2024. That could amount to 35% of $9.49 billion by 2025.

Since semiconductor manufacturers have already seen the value of outsourcing for their front-end needs, they’ll jump at the chance to build electronic housings with an additive manufacturing company that has connections in mainland China, Japan, South Korea, and Taiwan.

The United States has historically relied on fossil fuels — coal, oil, and natural gas — to meet its energy demands and even though dependence on fossil fuels has dipped slightly to around 80%, many consumers and manufacturers are concerned about global energy consumption. This has prompted a surge in interest in renewable alternative energy sources, and semiconductor device manufacturers are uniquely positioned to benefit from this trend.

Solar and wind energy are widely regarded as safe and pollution-free, but power from these sources requires sensitive electrical components that can cause system failure if exposed to harsh weather conditions. Therefore, manufacturers in the energy sector use electrical housings to protect their equipment and improve safety while remaining eco-conscious. This trend will continue to drive the electrical enclosures market — Mordor Intelligence reports indicate that the market will grow at a compound annual growth rate of 8.57% between 2020 and 2025.

Additive manufacturers can help the planet (and their bottom lines) by devoting resources to manufacturing housings that are specifically compatible with solar and wind energy sources. Manufacturers should also keep an eye out for opportunities to build enclosures from materials like ultraviolet-protected acrylonitrile styrene acrylate (ASA). Enclosures made of corrosion-free materials like ASA will experience significant adoption very soon because they can protect equipment from the harsh weather conditions that can damage renewable energy sources.

The semiconductor industry presents a fascinating study in product trends because, in an ever-connected world, almost every digital device in use today requires a semiconductor device. The possibilities are endless and the industry constantly evolves. The aforementioned technological and environmental trends only speak to a few of the most important shifts. Manufacturers should keep an eye on AI chips, head mounted displays in consumer electronics, and a spike in demand for semiconductor-powered electronic safety systems in the automotive industry.

At SyBridge, we have our finger on the pulse of the latest trends in digital manufacturing and beyond. Our partners have the opportunity to get in on the ground floor of exciting new projects and our team of industry experts will help you innovate — from the first steps in the design process all the way through to manufacturing and fulfillment. Contact us today to get started.

Forget typical cycle times. We're pushing the boundaries of conformal cooling. While traditional approaches deliver…

Forget typical cycle times. We're pushing the boundaries of conformal cooling. While traditional approaches deliver…

From left to right: Brayden Janak (apprentice); Logan Vifaquain (CNC machining, Programming and CMM); Ron…

SyBridge Technologies is proud to announce we have been awarded the 2023 General Motors Supplier…

Today, designers and engineers are accustomed to working with digital tools in their day-to-day jobs.…

Optimizing Your Injection Molding Process for Cost-Effective Manufacturing Excellence In today’s competitive landscape, manufacturers are…